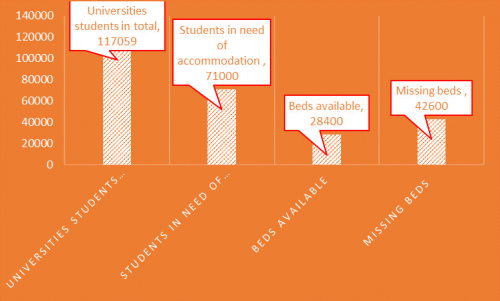

In recent years the number of international students enrolling in Prague universities has been growing and thus a demand for accommodation. The total population of HEI students used to decline each year on average by 3%. This downward trend has now been reversed and in the academic year 2020/2021 as many as 117 059 students enrolled in Prague universities. Currently, we have about 25 000 international and 46 000 Czech, in total 71 000 students who need accommodation.

According to a Savills survey, Prague-based operators of private PBSA rent their premises predominantly to international students who make up 80% of full-time university students in Prague. The Student Housing Market offers over 28 400 beds with 9% of this capacity provided by the private sector.

Prague universities continuously invest in the refurbishment and remodeling of their dormitories. However, even after these upgrade works are finished, the standard of living will not compare to privately owned rooms. With the number of consistently increasing foreign students in Prague, the number of privately owned residences has continued to rise. In March 2021 a total of 14 larger private residences were recorded and the total number of beds increased to around 2600. With approximately 42 600 beds missing, great business opportunities arise for the real estate market segment. Although there are no new ongoing PBSA projects under construction at the present time, several new student residences are planned across the city to be built in near future, but unlikely to hugely expand until 2023.

Based on the above findings there are in total 117 100 university students, out of which 84% are full-time and 25 500 arrive from foreign countries. Altogether the total capacity of beds available is about 28 400. Evidently, this demonstrates a huge gap in available accommodation mainly to foreign students who are usually willing to pay a higher price for a better standard of living. This brings a huge business opportunity to the property developers and investors in the Czech Republic. In the European context, the Czech Republic is among the emerging PBSA markets. Based on the low availability of existing prime student accommodation assets on the market and the increasing level of investor’s interest as well as the level of prime residential yields, it is estimated that prime yields for high-quality residences in Prague are at about 4.25%, according to RCA.